29

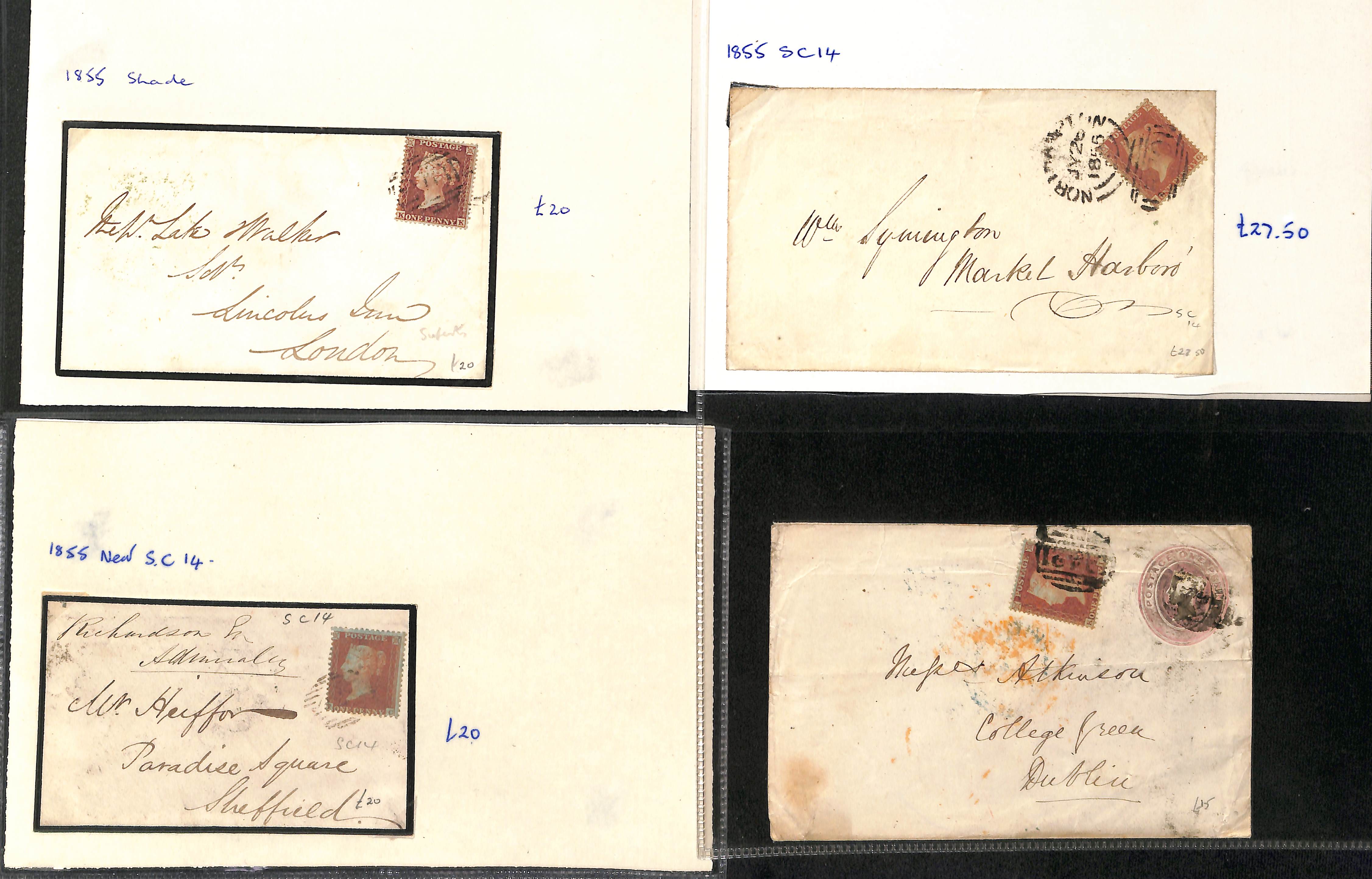

1854-80 Covers with 1d reds, comprising 1854-57 issues on blued paper (56), 1857-63 issues on

G.B & Worldwide Stamps and Postal History

Sale Date(s)

Venue Address

In house shipping

Important Information

Estimates and Reserves

Estimates are intended as a guide only for prospective purchasers. Any bid between the listed figures would, in our opinion, offer a fair chance of success. However, realised prices may be above or below estimates, which do not include Buyers Premium. All lots have reserves, at or below the low estimate. Reserves on the majority of lots are 85% of low estimate, but some reserves may be higher or lower than this figure. No bids will be accepted below the reserve price.

Buyers Premium

Purchasers Resident within Great Britain and the European Union Buyers premium on all lots is 22.8%. Further details are given in the notes on VAT below. Purchasers Resident outside the European Union Buyers premium on all lots is 19% provided all lots are posted to the purchaser by Argyll Etkin Limited.

Bidding Steps

Up to £50 in £2 or £3 steps (i.e. £15, £18, £20) £500 to £980 in £20 or £30 steps (i.e. £620, £650, £680) £50 to £95 in £5 steps £1000 to £1950 in £50 steps £100 to £290 in £10 steps £2000+ at Auctioneers discretion. £300 to £480 in £20 steps

Payment Methods

1) Cash. 2) Cheque or Sterling Bank Draft. Cheques should be made payable to “Argyll Etkin Limited”. No property will be released until such cheques have been cleared. 3) Debit and Credit Cards - Visa, Mastercard and American Express are accepted. A surcharge of 2½% will be added to the total invoice if payment is made by credit card, or by overseas debit cards. Buyers resident in the UK will have VAT added to this surcharge. 4) Bank Transfer, direct to our account at: HSBC - 69 Pall Mall, London, SW1Y 5EY HSBC’s Bank Identifier Code: HBUKGB4B Sort Code 40 - 05 - 20 Account No 71400975 IBAN No: GB43HBUK40052071400975 Branch Identifier Code: HBUKGB4107J Please indicate your name, account number and invoice number with the instructions to the bank and allow for additional bank charges incurred in order to clear the total balance due.

Value Added Tax

Purchasers Resident within Great Britain and the European Union Lots marked † after the lot number are imported from outside the UK under the auctioneers temporary import scheme. As such VAT at the reduced rate of 5% will be added to the hammer price. On all other lots there is no VAT on the hammer price. VAT at 20% will be added to the 19% buyers premium on all lots, including those sold under the auctioneers temporary import scheme. Although buyers premium includes an element of VAT it will be shown as a single inclusive amount and the VAT within this amount may NOT be reclaimed by the buyer even if the buyer is registered for VAT. 20% VAT will be added to the 2½% charge for paying by corporate credit card. 20% VAT will also be added to postage and packing charges.

Purchasers Resident outside the European Union There will be NO VAT CHARGES (on the hammer price, 19% buyers premium, credit card charges or postage and packing charges) provided Argyll Etkin post the lots to the purchaser. Therefore the only additions to the hammer price paid by purchasers outside the UK are the 19% buyers premium, postage and packing charges, and the 2½% charge if paying by credit card. Any purchaser collecting their lots in person will be treated as being resident within the UK for VAT purposes.

Terms & Conditions

Buyers Premium Purchasers Resident within Great Britain and the European Union

Buyers premium on all lots is 22.8%. Further details are given in the notes on VAT below.

Purchasers Resident outside the European Union

Buyers premium on all lots is 19% provided all lots are posted to the purchaser by Argyll Etkin Limited.

Up to £50 in £2 or £3 steps (i.e. £15, £18, £20) £50 to £95 in £5 steps

£100 to £290 in £10 steps

£300 to £480 in £20 steps

Bidding Steps

£500 to £980 in £20 or £30 steps (i.e. £620, £650, £680) £1000 to £1950 in £50 steps

£2000+ at Auctioneers discretion.

1) Cash.

Payment Methods

-

2) Cheque or Sterling Bank Draft. Cheques should be made payable to “Argyll Etkin Limited”. No property will be released until such cheques have been cleared.

-

3) Debit and Credit Cards - Visa, Mastercard and American Express are accepted. A surcharge of 21⁄2% will be added to the total invoice if payment is made by credit card, or by overseas debit cards. Buyers resident in the UK will have VAT added to this surcharge.

-

4) Bank Transfer, direct to our account at:

HSBC - 69 Pall Mall, London, SW1Y 5EY

HSBC’s Bank Identifier Code: HBUKGB4B

Sort Code 40 - 05 - 20 Account No 71400975

IBAN No: GB43HBUK40052071400975 Branch Identifier Code: HBUKGB4107J

Please indicate your name, account number and invoice number with the instructions to the bank and allow for additional bank charges incurred in order to clear the total balance due.

Value Added Tax

Purchasers Resident within Great Britain and the European Union

Lots marked † after the lot number are imported from outside the EU under the auctioneers temporary import scheme. As such VAT at the reduced rate of 5% will be added to the hammer price. On all other lots there is no VAT on the hammer price. VAT at 20% will be added to the 19% buyers premium on all lots, including those sold under the auctioneers temporary import scheme. Although buyers premium includes an element of VAT it will be shown as a single inclusive amount and the VAT within this amount may NOT be reclaimed by the buyer even if the buyer is registered for VAT. 20% VAT will be added to the 21⁄2% charge for paying by corporate credit card. 20% VAT will also be added to postage and packing charges.

Purchasers Resident outside the European Union

There will be NO VAT CHARGES (on the hammer price, 19% buyers premium, credit card charges or postage and packing charges) provided Argyll Etkin post the lots to the purchaser. Therefore the only additions to the hammer price paid by purchasers outside the EU are the 19% buyers premium, postage and packing charges, and the 21⁄2% charge if paying by credit card. Any purchaser collecting their lots in person will be treated as being resident within Great Britain for VAT purposes..